.jpg&w=3840&q=75)

India-EU Free Trade Agreement: An overview

Anjali Hirawat

PartnerKedar Kokatay

AssociateAntara Bhide

AssociateOver the last few years, India has been actively working towards increasing integration of ‘Made in India’ goods and services in the global market. Recent Free Trade Agreements (‘FTAs’) with UK, EFTA, New Zealand, Oman, Australia, UAE, among others, are reflective of such efforts and commitments. In furtherance of this objective, India has concluded negotiations with the European Union (‘EU’) for the India-EU FTA on 27 January 2026.

The India-EU FTA is arguably the most significant FTA concluded by India in this decade considering that India and EU are two of the largest economies and top contributors to the Global GDP. India will hugely benefit from this FTA, as 97% of tariff lines (99.5% of trade value) are covered by it which is likely to result in increased EU market access. Similarly, with 92.1% tariff lines being covered for EU (97.5% of the EU exports), EU is expected to save duties of €4 billion per year on their products along with access and competitive advantage in trading with the world’s fastest growing major economy.

Market Access: Sectors expected to gain

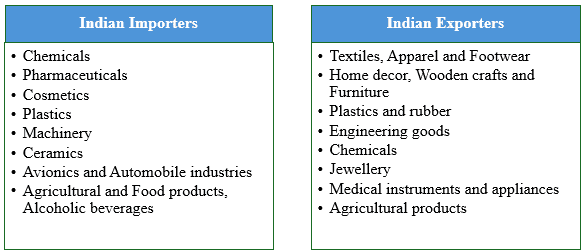

Indian importers and exporters can expect the following sectors to benefit from the India-EU FTA:

Key sectors for Indian Importers

1. Machinery and electrical equipment

o Machinery and electrical equipment accounts for the largest exports from EU to India in terms of value. At present, these imports from EU are taxed at around 44%.

o Indian importers to enjoy tariff elimination on import of most of these goods in a phased manner, approximately 10 years from the date of enforcement of the FTA.

2. Avionics and automobile industry

o Aircrafts and spacecrafts contribute to second highest exports from EU to India in terms of value, which was around €6.4 billion in 2024 alone.

o At present, import of aircrafts is taxed at 11%, which will eventually be eliminated for almost all such products in a phased manner in 10 years from the date of enforcement of the FTA.

o Import of EU cars which are presently taxed at 110% will be taxable at 10% (reduced duty benefit available only for up to 2,50,000 numbers of motor vehicles imported a year). Further, most automobile parts will also be duty free in a phased manner in 5 to 10 years from the date of enforcement.

3. Chemicals, Iron and Steel, Medical equipment

o Import of chemicals is currently taxed at up to 22%. Import of iron and steel is taxed at up to 22% while import of optical, medical and surgical equipment is taxed at around 27.5%.

o Duties on almost all these products are going to be eliminated with effect from entry into force of the agreement. Duty on few products shall be eliminated in a phased manner up to 10 years from the date of enforcement of the FTA. Only a miniscule number of products falling under these categories will not receive the benefit of duty free import.

Key sectors for Indian Exporters

1. Textiles, Apparel and Footwear

o After USA, EU is India’s 2nd largest export destination for textiles and apparel.

o India-EU FTA offers zero-duty access for textiles, footwear and clothing, and covers all relevant tariff lines. This will result in opportunities for expansion of labour-intensive segments such as ready-made garments, cotton textiles, man-made fibre, and home textiles.

o Indian textiles and clothing will now be price competitive with exports from countries like Bangladesh, Pakistan and Turkey.

2. Agricultural goods

o Tea, coffee, spices, grapes, cucumbers, dried onion, fresh vegetables and fruits as well as processed products will receive preferential market access. This intends to strengthen farmers’ realized income and reinforce rural livelihoods by elevating global competitiveness of Indian agricultural products.

3. Medical instruments, Appliances and Engineering goods

o 99.1% of relevant tariff lines receive up to 6.7% tariff elimination, enabling cost-competitive entry of medical instruments, appliances and vital supplies into EU.

o Resultantly, there will be increased opportunities for expansion of industries such as lenses, spectacles, medical devices, measuring and testing instruments.

o Engineering goods will receive preferential market access, empowering MSME-led industrial hubs and global competitiveness.

Indian businesses can consider the above concessions and relaxations sought to be introduced by the India-EU FTA and strategize on how they can optimize their sourcing and supply chains to reduce costing and increase their market share in both the parties.

Rules of Origin

The Rules of Origin agreed between the parties are consistent with recent EU FTAs and will ensure that only products which are significantly processed by one of the parties can benefit from the agreement.

Further, the proof of origin for availing benefit of the FTA will be in the form of a statement of origin which the exporters will need to upload onto a portal. This shall allow the importing party’s customs authorities to verify the authenticity of the same. The documentation on origin will follow the latest standards based on self-certification by businesses making it easier for small and medium-sized businesses to benefit from the preferential tariffs.

Carbon Border Adjustment Mechanism

The Carbon Border Adjustment Mechanism (‘CBAM’) emerged as one of the most fiercely contested issues during the negotiations for the India-EU FTA, with India expressing strong concerns over its potential impact on carbon-intensive exports such as steel and aluminum.

The negotiations have concluded with the EU firmly maintaining the integrity of CBAM refusing any dilution, exemption, or suspension of the levy. However, India has been able to secure meaningful safeguards and cooperative commitments in the final deal.

These include:

• a forward-looking Most Favoured Nation (‘MFN’) assurance, ensuring that any future flexibilities or concessions granted to third countries under CBAM regulations will automatically extend to India;

• enhanced technical cooperation on the recognition of carbon pricing mechanisms and mutual acceptance of verifiers to streamline compliance;

• dedicated transition support, including financial assistance (notably 500 million Euros envisaged over the next two years) to aid India’s decarbonization efforts and help industries adapt to emerging carbon requirements.

This balanced outcome reflects a pragmatic approach, preserving the EU’s climate policy tool while providing India with pathways for dialogue and practical support to mitigate trade disruptions.

Other notable aspects

Apart from providing for major tariff concessions on trade of goods, the India-EU FTA also provides for the following key aspects in furtherance of facilitating trade and protecting interests of both parties:

• Sensitive sectors: To ensure stability of the domestic market, India has safeguarded sensitive sectors such as dairy, cereals, poultry, soymeal, certain fruits and vegetables and not provided tariff concessions on such products.

• Trade in services: The FTA will provide for faster growth of trade in services by focusing on non-discriminatory treatment, ease of mobility for Intra-Corporate Transferees (‘ICT’), Business Visitors, entry and working rights for dependents / family members of ICTs, framework on social security agreements, etc. Consequently, India will gain access to 144 service subsectors of EU while EU will gain access to 102 service subsectors in India.

• Small and Medium Enterprises (‘SMEs’): India-EU FTA focuses on encouragement of SMEs by providing for a publicly accessible digital platform containing information on how to access and do business in markets of both parties. Further, both parties will set up contact points who will assist SMEs to find ways to benefit from the FTA and facilitate seamless procedure for claiming benefit under the FTA.

• Reduced red tape: To reduce red tapism, the FTA will provide for transparency provisions, provisions on advance rulings, expedited release of goods and overall simplified procedures for availing benefit of the agreement. This is expected to simplify trading and reduce costs for both parties.

Way forward

India-EU Free Trade Agreement is indeed a milestone in India’s global trade journey. This FTA not only provides unprecedented access for India to the world’s largest single market but also strengthens bilateral ties between India and EU and enhances India’s strategic positioning in a multipolar world.

While the negotiations for the India-EU FTA have concluded, the Agreement is to be adopted by the EU Council and thereafter, signed and ratified by both the parties before it enters into force. This time period can be effectively utilised by the businesses to analyse the impact of the FTA on its business operations, existing supply chains and proposed investments in order to optimise the benefits from this landmark deal.

[The first author is Partner while the other two authors are Associates in International Trade practice at Lakshmikumaran & Sridharan Attorneys, Mumbai]

Related Articles

VIEW ALLNews

VIEW ALLEXPLORE

Connect With Us

Contact us today and let's find the right solution for your business challenges.